The study involved major activities in estimating the current size of the live entertainment market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the live entertainment market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

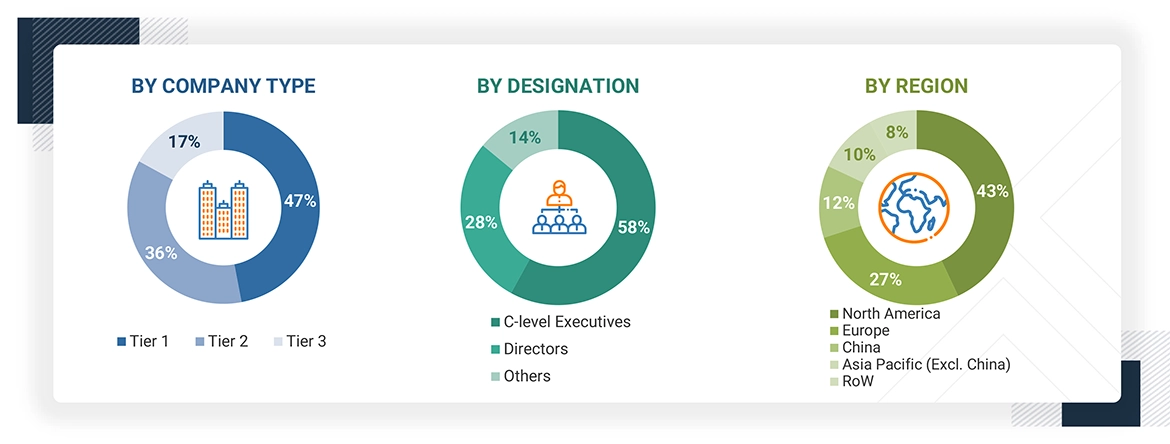

Extensive primary research was conducted after gaining knowledge about the current scenario of the live entertainment market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: RoW mainly comprises the Middle East & Africa, and Latin America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024; tier 3: revenue lesser than USD 500 million; tier 2: revenue between USD 500 million and 1 billion; and tier 1: revenue more than USD 1 billion. .

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the live entertainment market.

-

Identified major global players delivering live entertainment services and assessed their market presence

-

Analyzed revenues across different segments within the live entertainment market to identify growth drivers

-

Estimated revenue contributions from key market players providing live entertainment services

-

Obtained the global market size for live entertainment, offering a baseline for evaluating market potential

The top-down approach has been used to estimate and validate the total size of the live entertainment market.

-

Estimated the total market size for live entertainment, outlining the overall scope and growth potential of the market

-

Analyzed the regional market distribution, with further estimation of individual country shares within each region to identify localized trends and differences

-

Estimated the market segmentation based on application (music concets, sports events, e-sports, and theaters & musicals, offering insights at both regional and national levels

-

Calculated market size across various applications and streaming type

-

Estimated the application-wise market distribution at the regional level, highlighting how different applications influence market dynamics across regions

Live Entertainment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the live entertainment market.

Market Definition

The live entertainment market refers to the sector of the entertainment industry where audiences engage with content in real-time or near-real-time, typically within a shared space—either physical or virtual. This market includes a wide range of experiences such as live music concerts, sports events, theatre and musicals, movies, and e-sports, while excluding theme parks. Venues span from large-scale stadiums and arenas to medium and small-scale settings like cinemas, pubs, and karaoke rooms, as well as digital platforms such as the metaverse. Live entertainment is categorized into three main formats: real live, where performers and audiences are physically co-present; satellite live, where audiences share a physical space but view content via live broadcast without performers present; and virtual live, where audiences participate alone in a virtual environment. Content delivery can be real-time (online streaming) or non-real-time (recorded or pre-recorded), reflecting the evolving modes of audience engagement in the digital age.

Key Stakeholders

-

Event organizers and promoters

-

Artists, performers, and talent agencies

-

Venue owners and operators

-

Streaming platforms and digital media partners

-

Ticketing service providers and distributors

-

Sponsorship and advertising partners

-

Technology solution providers (AR/VR, sound, lighting, event tech)

-

Merchandise vendors and brand licensors

-

Government and regulatory authorities (for permits, safety, crowd control)

-

Fans and audience members (in-person and virtual)

Report Objectives

-

To define, describe, and forecast the size of the live entertainment market by application and streaming type, in terms of value

-

To provide information about technologies, value chain, and viewing experience associated with live entertainment

-

To describe and forecast the market size for various segments concerning key regions, namely, North America, Europe, China, Asia Pacific (excl. China), and RoW, in terms of value

-

To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To understand and analyze the impact of evolving technologies on the overall supply chain of the live entertainment market and upcoming trends in the ecosystem

-

To provide macroeconomic outlooks with respect to the main geographies, namely, North America, Europe, China, Asia Pacific (excl. China), and RoW

-

To provide a detailed overview of the live entertainment market industry trends and use cases.

-

To strategically analyze micromarkets for individual growth trends, prospects, and contributions to the total market

-

To provide ecosystem analysis, trends/disruptions impacting customer business, case study analysis, ecosystem analysis, and Gen AI/ AI impact related to the live entertainment market

-

To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

-

To analyze the competitive developments, such as acquisitions, service/solution launches, expansions, agreements, partnerships, and collaborations carried out by market players

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Live Entertainment Market